This week, Jennifer and Will took part in the inaugural Private Equity AI Strategy breakfast briefing, courtesy of AI Pathfinder.

The session brought together key players in the PE space with technology companies who offered their expertise in navigating the various twists and turns of the AI landscape as it relates to investment opportunities.

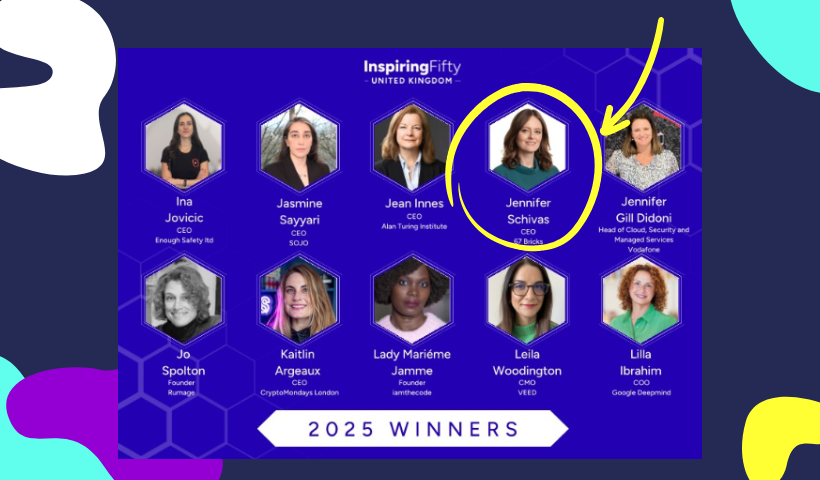

Following the event, Jennifer noted down for us her key takeaways.

GenAI is all about predictions – it’s a natural fit for PE

One of the biggest benefits of GenAI is its ability to power faster predictions, using more data, and on a larger scale than was previously possible. This is the main reason why it is critical for PE firms to get started on utilising it properly – it changes the parameters of what is possible in a fundamental way for an industry which is all about minimising uncertainty. What’s more, PE firms are in a unique position to support their portfolio companies to prepare for and adopt AI. This is starting to happen, but it was agreed in the room that for the most part this was not being done systematically or strategically – yet.

AI is a big consideration for new investment decisions

We are in an era where every investment can be dramatically influenced by AI – either as a potential risk or as an accelerant. So now is the time to take action and make sure that its impact is well understood. But this shouldn’t be done separately to other business planning – companies need to be clear on their goals. From there they can experiment and iterate to find the most valuable actions, but it has to be tied back to company outcomes.

Normalise the use of AI in your business – and get in the right help

There was definitely a sense that companies need to get more comfortable with the tools available, and make it much more normal for them to be used day-to-day. That being said, there are clear benefits to doing this with the help of experts. Partnering with knowledgeable technology consultancies (like 67 Bricks!) is a good way to get started quickly, minimize learning costs and benefit from experience built up with other clients. Additionally, PE firms who can bring in experts in this space, may become more appealing as investors – similar to bringing in specialists on things like pricing for example.

Get moving to maximise value

One big challenge mentioned was whether enterprises can innovate faster than start-ups can create and distribute competitive experiences. Again, bringing in partners to support innovation and to build products quickly is key to remaining competitive in every space. For our partners – who tend to be in the business of information and data – it is as much about managing existential risk in a GenAI enabled world as it is jumping on new opportunities. Regardless of where you sit, staying still is not an option.